Iran’s government budget reveals tough road ahead as currency hits new low

26 December 2025

26 December 2025

Tehran, Iran – Iran’s currency has been registering new lows amid ongoing economic turmoil that is also reflected in a planned budget for next year that effectively shrinks public spending.

Each United States dollar was priced at about 1.36 million rials in the open market on Wednesday in Tehran, its highest rate ever, before the Iranian currency slightly regained ground on Thursday.

- list 1 of 3Pope Leo laments suffering of Gaza Palestinians in first Christmas sermon

- list 2 of 3Turkiye arrests 115 ISIL suspects it says planned holiday attacks

- list 3 of 3Israel says member of Iran’s IRGC among several killed in Lebanon strikes

end of list

The embattled national currency has been rapidly declining over recent weeks as the US and its Western allies pile on their sanctions and diplomatic pressure, and the threat of another war with Israel lingers.

President Masoud Pezeshkian this week sent his administration’s finalised proposed budget to the hardline-dominated parliament for the upcoming Iranian calendar year, which starts in late March. The budget will then have to be greenlit by the 12-member Guardian Council before being ratified into law in the coming weeks.

The presented budget nominally grew by just over 5 percent compared with last year, but inflation currently stands at about 50 percent – indicating that the government envisions lower spending while managing a so-called “resistance economy” as it faces a massive budget crunch yet again.

But minimum wages are to be raised far below the inflation rate, too, at only 20 percent, meaning that Iranians are once more guaranteed to have far less spending power next year as the embattled national currency sinks.

At the same time, the budget says the government sees taxes rising by a massive 62 percent next year, as authorities try to gradually decrease dependence on oil revenues amid US efforts to drive down Iranian exports, which are carried by a shadow fleet of ships mostly to China.

Advertisement

At the current exchange rate, the whole budget is worth about $106bn, several times lower than the projected 2026 budgets of regional players like Turkiye, Saudi Arabia and Israel.

Iran’s rent-distributing multi-tier exchange rate system is still at play, with the government proposing allocating a rate for customs duties, import valuation and budget accounting tables, and another closer to the open market rate used for oil revenue realisation.

An earlier subsidised exchange rate, which was far lower than the open market rate, has now been abandoned. Any excess cash resulting from this is expected to be doled out to low-income Iranians in the form of electronic coupons that can be used to buy essential items like food.

For the first time, the budget is drafted in new rials as four zeros are expected to be removed from the ailing national currency by the time the budget is operational for next year.

After years of back and forth, the parliament in October approved the government plan to lop off four zeros. The move is only cosmetic and will not help with the runaway inflation, but proponents argued it was necessary after years of currency devaluation.

Several major factors have already been raising alarm over how bad the economic situation could become next year.

Iranians online reacted poorly to the fact that the government predicts wages will be far outpaced by inflation and tax collection. Others were concerned that eliminating the subsidised rate for essential goods could cause another price shock in the short term.

Many shared a video of Pezeshkian from last year running for president, when he said during a televised interview that the stark disparity between wage increases and inflation is a “grave injustice” being done to the Iranian people.

“Unfortunately, so long as we do not resolve the structural issues, we are making labourers and government workers poorer by the day while those with money get bigger and bigger,” Pezeshkian said at the time.

“This inflation is an additional tax on the poor and the disenfranchised.”

But successive governments have failed to eliminate budget deficits or rein in banks teetering on the brink of insolvency, therefore relying on the central bank to print more money to run the country and, in turn, exacerbate inflation.

Earlier in December, the government proceeded with increasing the price cap of petroleum despite repeated assurances it had no plans to that effect this year. The move has already led to increased transport costs, which will end up taking inflation higher.

Advertisement

There are now four price tiers for petroleum, with the cheapest and lowest quality that is available to most Iranians costing up to 50,000 rials per litre (about $1.19) and higher quality imported fuel delivered this week at 800,000 rials per litre ($19).

Hamid Pourmohammadi, who heads the Plan and Budget Organization of Iran, insisted that the government has devised a 20-point plan to be unveiled soon that will reduce pressure on the livelihoods of Iran’s 90 million population.

“The government is trying to adopt an active approach to address the economic challenges of the people, businesses and economists, so there is no perception of complacency in these economic conditions,” he said.

Related News

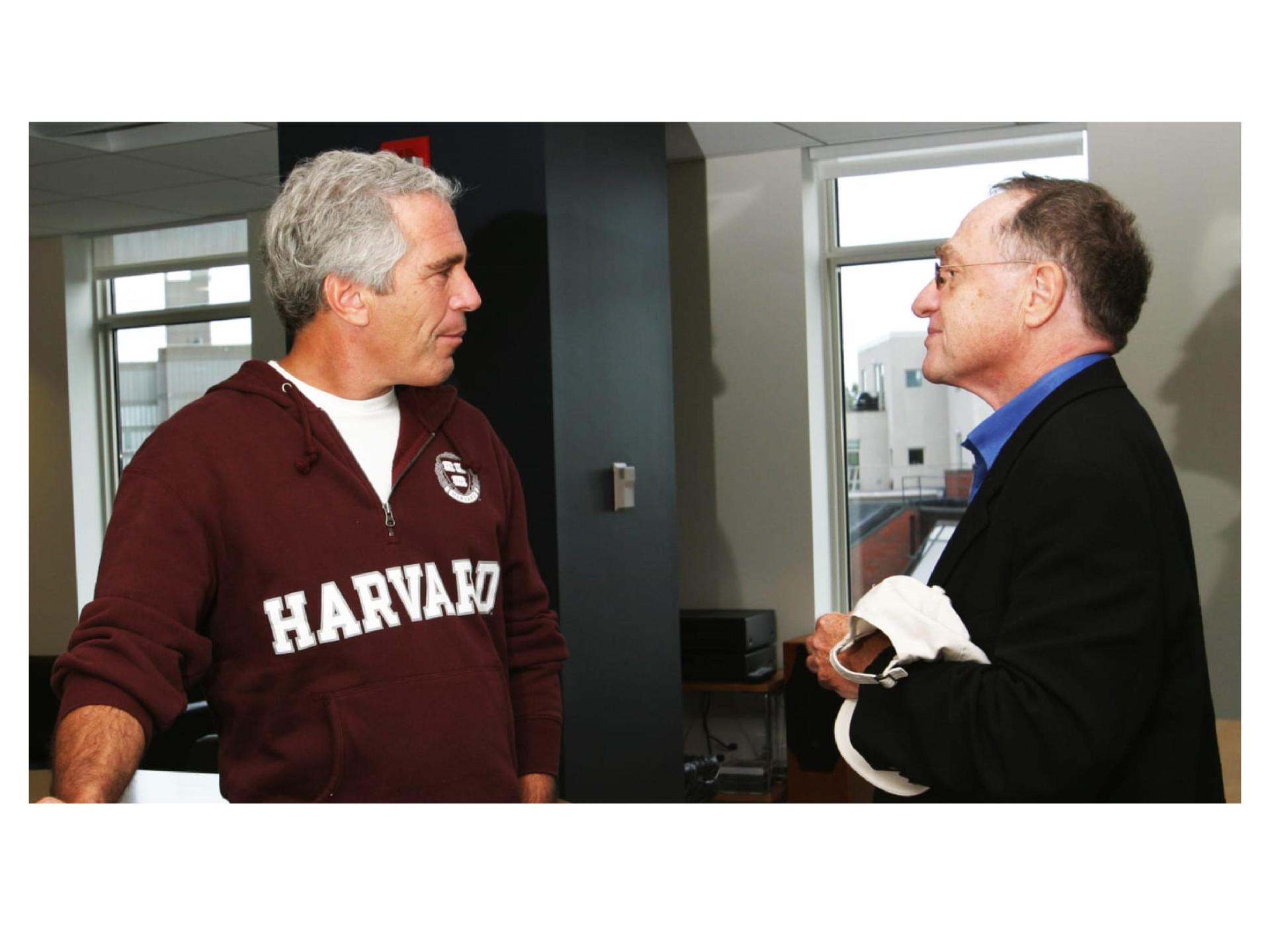

Jeffrey Epstein accomplice Ghislaine Maxwell seeks prison release

US Congress releases Epstein estate photos featuring Trump, Clinton

US pursues another oil tanker near Venezuela: Reports