Tax Administration Jamaica (TAJ) is reminding individuals who are eligible for the Reverse Income Tax Credit (RITC) that the deadline for applications is this Friday, December 13, at 11:59 pm.

This means that all new applicants must submit their applications via the tax authority’s website www.jamaicatax.gov.jm on or before the stated deadline, in order to benefit from the Government’s one-time tax giveback of $20,000.

Additionally, individuals whose applications were rejected, may resubmit the applications by Tuesday, December 31, 2024.

Taxpayers whose applications were processed for disbursements in November 2024, should have been in receipt of the $20,000 disbursements in the stated bank accounts or available for pick-up at the respective remittance agencies that were indicated on their applications.

Persons who may still be experiencing challenges are advised to contact Tax Administration Jamaica’s Communications Unit at 116 East Street (4th Floor), Kingston, telephone: 922-3470-9; e-mail: [email protected]; website: www.jamaicatax.gov.jm; Facebook: www.facebook.com/jamaicatax; TAJ via (888) TAX-BACK/ (888) 829-2225; or [email protected] for updates and support.

Taxpayers are further reminded of the Reverse Income Tax Credit Hub, which is available on the TAJ portal at www.jamaicatax.gov.jm, to facilitate the submission of applications, and getting relevant information about RITC, including frequently asked questions.

TAJ said the process from application to disbursement spans a minimum of four weeks from the time a confirmed application is submitted via the tax portal at www.jamaicatax.gov.jm.

The beneficiaries are reminded that they will receive a notification via SMS text message or email, advising when the disbursement is made to the financial Institution or remittance agency of their choice, as well as if there is a subsequent challenge with the information provided.

Alternatively, successful applicants may use the ‘Track Status of Application’ option on the RITC hub at www.jamaicatax.gov.jm. TAJ is advising that only persons who have confirmed that the money has been disbursed should visit their financial institutions or remittance agencies.

Persons interested in submitting their applications will need to have at hand their Taxpayer Registration Number (TRN), valid Jamaican dollar banking information, and telephone number and email address, to complete and submit the online application.

They may also choose from a list of participating financial institutions or remittance agencies to receive the disbursements.

For further information, persons may contact (888) TAX-BACK/(888) 829-2225, [email protected], or visit www.jamaicatax.gov.jm

Related News

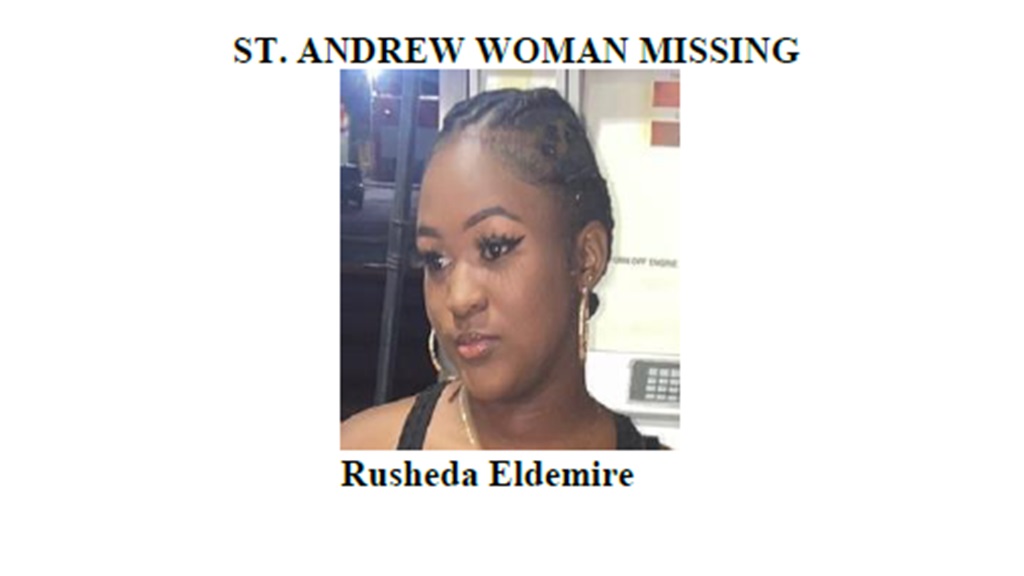

18-year-old female gone missing from Marverly, St Andrew

Several residents marooned in Barking Lodge, St Thomas due to flooding

Chukka Adventures named World's Leading Destination Experiences